Canada’s Life Settlements Market – In the News

Unlocking the Hidden Value of Life Insurance

In Quebec, life settlements are helping seniors turn dormant life insurance policies into financial tools to support health, housing, or legacy planning. Canadian Life Settlements, a Montreal-based firm, offers tailored solutions to policyholders 70+ or with serious health issues, providing far more than traditional cash surrender values.

How to Transform Your Life Insurance into Retirement Income?

As highlighted on Bonjour Résidences, life settlements offer Quebec seniors an innovative way to unlock the value of their life insurance policies. By selling an underutilized policy, seniors can access immediate funds to cover healthcare, senior living expenses, or enhance their retirement lifestyle.

How Canadian Life Settlements are expanding the use of life insurance

Canadian Life Settlements offers innovative financial solutions for unlocking the value in life insurance policies, providing options that are up to 500% more valuable than traditional Cash Surrender Value. The Montreal-based company aims to help seniors optimize their life insurance assets, while also offering responsible investment opportunities.

Ontario proposal would open life insurance to secondary market

A private member’s bill that would permit Ontarians to sell their life insurance policies to a third party has once again put the controversial issue of life settlement transactions before lawmakers, and the industry is pushing back.

Life settlements’ can help vulnerable seniors get needed cash from their insurance policies

About three years ago, Morris and Ruth Adams were running out of money. The Toronto couple — he was then 91 and she was 89 — had spent close to $300,000 over eight years to pay for private caregiving services for Ruth.. View Online (Subscribers Only)

‘I believe so firmly in this that I’ve taken a stand’

In its newest pre-budget submission to Ontario, the Canadian Life and Health Insurance Association (CLHIA) urged the government to reject Bill 219, a bill that seeks to modernize the province’s Insurance Act by amending Section 115.

Ask The Experts: Life Settlements and Bill 219

Paul Tyers and Ian Grant discussed Ontario’s life settlement industry and Bill 219. This bill has already passed second reading in Ontario’s legislature and would modify the insurance act to allow consumers the option to sell or borrow against unwanted policies instead of letting them lapse.

Life Settlement Companies Seek Legislative Validation

When aging clients find themselves holding an in-force, life insurance policy that they no longer need or can afford, they may believe that letting the policy lapse is the only course of action available to them. However, obtaining a life loan or life settlement may be a viable alternative to letting their policies lapse…

Life Settlements: Ask the Experts

Ask The Experts with Iain Grant is an opportunity for you to talk directly to the movers and shakers. In this episode he and Paul Tyers discuss the life Settlements Market in Canada.

A 91-Year-Old’s Fight to Take Care of His Wife — By Legalizing Life Settlements

Morris Adams is worried about running out of money to pay his wife’s caretakers so she can remain at home. His wife, Ruth, suffers from depression and some dementia, and he has paid for aides to assist her for the past eight years…

Thawing of Canadian Life Settlement Market – Pro Consumer Developments for Canadian Policyholders – Finally

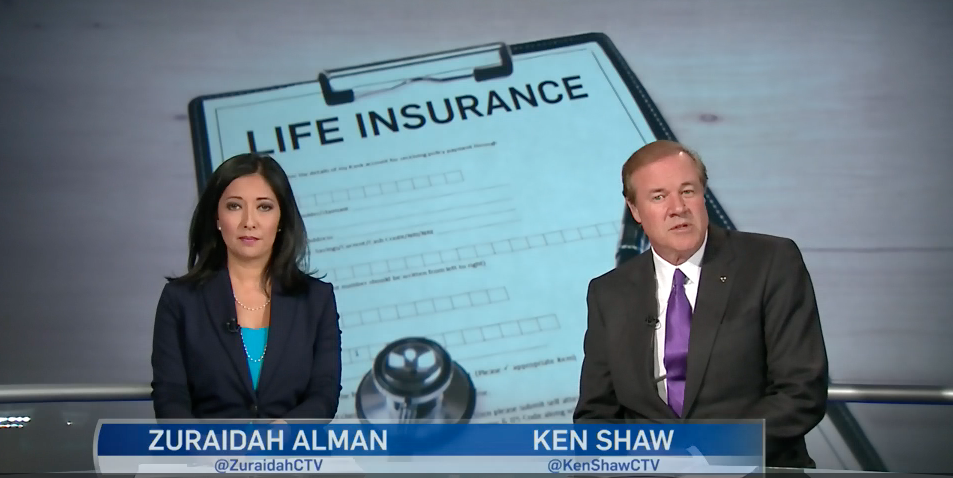

Pat Foran: Life Settlements good option for seniors

Two Minute Video