Life Insurance Agents

As an advisor, the primary reason for considering life settlements is you have the potential to help your clients. Although not all life insurance policies are good candidates for securing a loan or a life settlement, in certain circumstances these transactions could be the best option for dealing with your client’s redundant or unaffordable insurance contract.

Have a client referral? Click here to get a policy valuation.

Download our Complimentary Agent’s guide to the Canadian Life Settlement Industry

To gain access to our white paper, past webinars and other excellent resources fill out the form below.

Some Important Reminders for Financial Professionals:

Most Canadian Policyholders are unaware that they have the rights to sell their policy

However, written into the contractual paperwork of all Canadian life insurance is a policyholder’s right to transfer policy ownership and change the policy beneficiary. Furthermore, Canadian policyholders may accept money for doing so.

Canadian Life Settlements can Currently buy policies in one province

Life Settlements are currently permitted only in Quebec.

What is a Life Settlement and a Life Advance?

The term life settlement refers to a life insurance policy that has been sold to a third party. A life advance refers to a situation in which a client is borrowing against their life insurance policy. In this scenario beneficiaries still receive a portion of the death benefit when the insured passes away, once the cash advance, future advanced premiums, fees and interests are deducted.

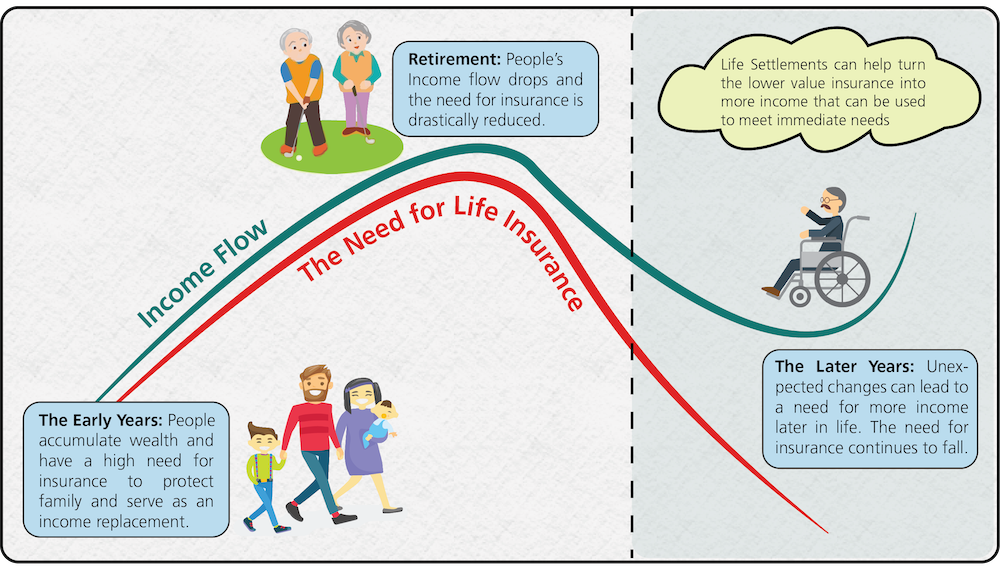

How can a life settlement or loan be beneficial to your clients?

A client might consider a life settlement or advance when their circumstances change and they no longer need the life insurance policy, they need money for another matter or the premiums on the policy have become too expensive.

Who qualifies for the life settlements program?

In order to qualify for a life settlement. a person must either be over the age of 70, or, have a serious medical condition that will significantly impair their longevity.

Do you offer referral fees for agents?

We do have a referral program for life insurance agents. If you would like more information on this, please send us an email at info@canadianlifesettlements.com